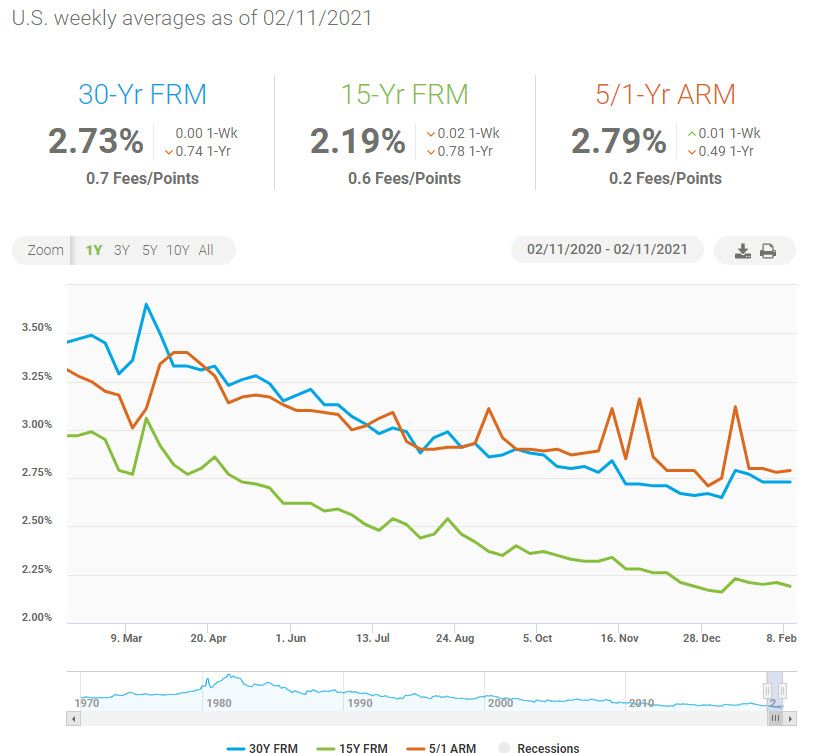

Would-be buyers in 2021 have many of the same advantages and challenges that have we’ve seen in a housing market that has been ultra-competitive since regaining its footing after the initial pandemic dip. Lower mortgage rates make monthly payments for higher-priced homes more manageable, but finding a home that checks the right boxes amid limited supply and saving up for the larger down payment needed with higher home prices continue to be challenging, especially for first-time homebuyers who haven’t accumulated home equity as prices have gone up. To tackle these challenges, would-be buyers need to get their finances in order and use tools that will support quick, solid decisions in a fast-moving housing market.

Weekly Housing Trends Key Findings

Key Findings:

- Median listing prices grew at 13.5 percent over last year, notching 25 consecutive weeks of double-digit price growth. With home shoppers active and sellers still waiting, this trajectory seems unlikely to change in the near term. In 2020, lower mortgage rates helped offset the sting of higher prices, but with mortgage rates expected to rise in 2021, affordability is likely to become a bigger challenge in 2021. Additionally, even if mortgage rates help blunt the effects of higher home prices on monthly payments, they don’t offset the need for larger down payments as home prices rise. While some would-be home buyers may find a solution to saving for a down payment by moving in with family, others will need to find different ways to save up.

- New listings continue to fall behind the year-ago pace–registering 21 percent lower for the second week in a row. After the upswing in new listings at the end of 2020, new listings have to tread a different path in 2021. New listings are a smaller sample and thus the trends are noisier than for active inventory, but the persistent declines observed so far in 2021 indicate that potential sellers aren’t in a hurry to do so early in the year. Fortunately for would-be homebuyers, we expect sellers to return to the market as we see improvement in the economy and progress against the pandemic. Further, new construction, which has risen at a year-over-year pace of 20% or more for the last few months, will provide some additional relief.

- Total active inventory continues to decline, dropping 45 percent. With buyers active in the market and seller participation lagging, homes are selling quickly and the total number available for sale at any point in time continues to drop lower. In January as a whole, the number of for-sale homes dropped below 600,000.

Time on market was 10 days faster than last year meaning that buyers still have to make quick decisions to succeed. Today’s buyers have many advantages including the ability to be notified as soon as homes meeting their search criteria hit the market. By tailoring their search and notifications to the homes that are a solid match, they can act quickly and compete successfully in this faster-paced housing market.

Source: Realtor.com