What this Week’s Data Means

Sentiment among homebuyers and potential sellers may have dipped in January, but it hasn’t dampened activity according to the indicators we track weekly. Realtor.com’s weekly housing data points to a brisk housing market as we move into February. The pace of home price growth ticked higher and homes are selling even faster than this time last year. The number of homes actively available for sale remains at all-time lows at least in part because builders have not kept up with household growth over the last decade. In fact, our recent analysis suggests that the housing shortage worsened in 2021 despite some of the best housing starts figures in 15 years.

Key Findings

The median listing price grew by 11.9 percent over last year.

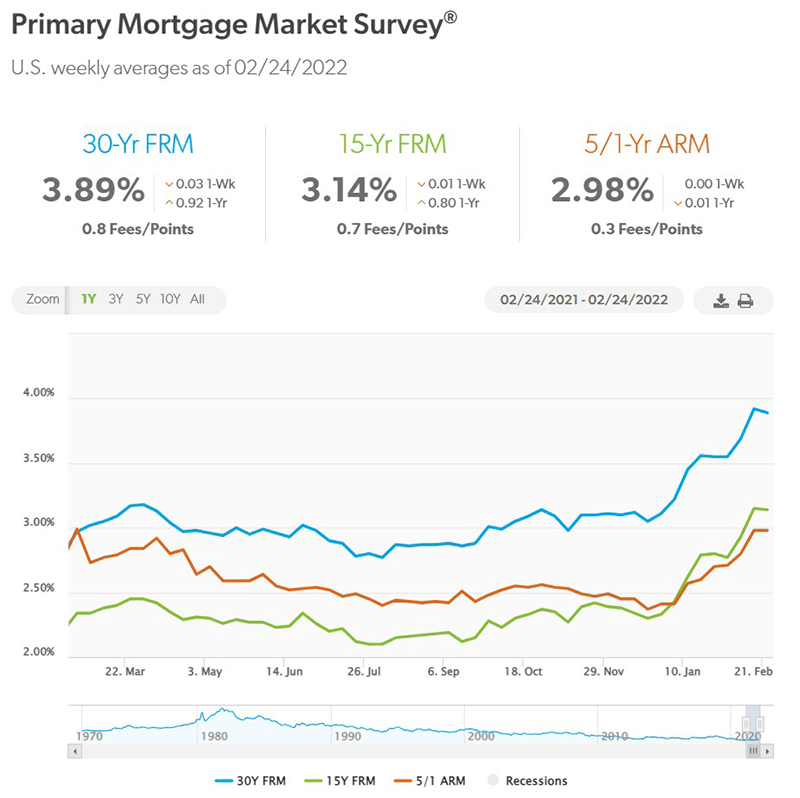

After a period of steady 8.5 to 9.0 percent growth in the fall, the median listing price for homes ratcheted back up to a double-digit pace in December. In 2022, not only has price momentum held, so far it has increased. Mortgage rates have risen half a percentage point in the last month as investors anticipate Fed funds rate hikes to begin as soon as next month. Rising rates have driven a rush on new home sales as buyers try to sign contracts to lock-in rates and beat further cost increases even as pending contracts on existing home sales have been held back by limited inventory. Our 2022 Housing Forecast expects a slowdown in home price growth to low-single digits for the year as higher rates reduce homebuyer purchasing power, but the median list price hasn’t yet moved in that direction.

New listings–a measure of sellers putting homes up for sale–were down 7 percent from last year.

In a housing market short on inventory, new home listings are a key indicator for future home sales. They indicate the number of sellers putting homes up for sale, in other words fresh supply. New listings finished 2021 on a somewhat weaker note and have trended below previous year levels for 10 of the past 12 weeks. Until this week, the pace of decline had shrunk since the start of the year. Without new listings relief, homebuyers face the possibility of another spring homebuying season without many options. In fact, our recent analysis of U.S. housing supply shows that the gap between household formation and single-family home construction grew in the last year, even as construction hit multi-year highs.

Active inventory is down 27 percent from a year ago.

With fewer new listings added this week, buyer interest again outpaced new selling, and we still see a sizeable gap in the number of homes actively for sale relative to last year. Although a smaller number of homes for sale creates challenges for buyers and sellers–many of whom will also be buying a home–it is a reflection of strong buyer demand thanks to a roaring labor market that has unemployment below 4 percent. Nonetheless, recent housing sentiment shows that buyers and sellers alike are beginning to wonder how long the competitive jobs market will last.

Strong buyer interest drives time on market down 10 days from last year.

With fewer homes for sale now than this time last year, homes are selling faster and successful buyers have to move quickly. For context, a typical home spent just 61 days on the market in January, faster than any pre-pandemic year’s fastest month. This market can be especially challenging for first-time buyers who may hesitate to contend. This can be especially true of black Americans who, in addition to contending with various forms of discrimination, often have lower incomes, and thus a smaller set of affordable homes to choose from.

Realtor.com