What this Week’s Data Means:

Climbing mortgage rates kept fueling competition in the housing market this week as home prices continued to grow at a higher pace than we saw last week. During the same week the previous year, a severe, nationwide storm disrupted the housing market, as many markets contended with snow and a severe freeze. Would-be buyers and sellers last year put plans on hold as they grappled with clean-up, leading to a dip in new listings and brief increase in time on market. Comparing this week to that disrupted week last year, we see a huge improvement in new listings and much lower time on market. Nevertheless, the trend of newly listed homes for sale this week would be positive for the first time this year even after adjusting for the storm’s impacts. This is also true for selling speed, which remains faster than one year ago even after accounting for the weather. In addition, the annual rate of homes actively for sale has steadily improved over time, showing an encouraging signal from the housing market.

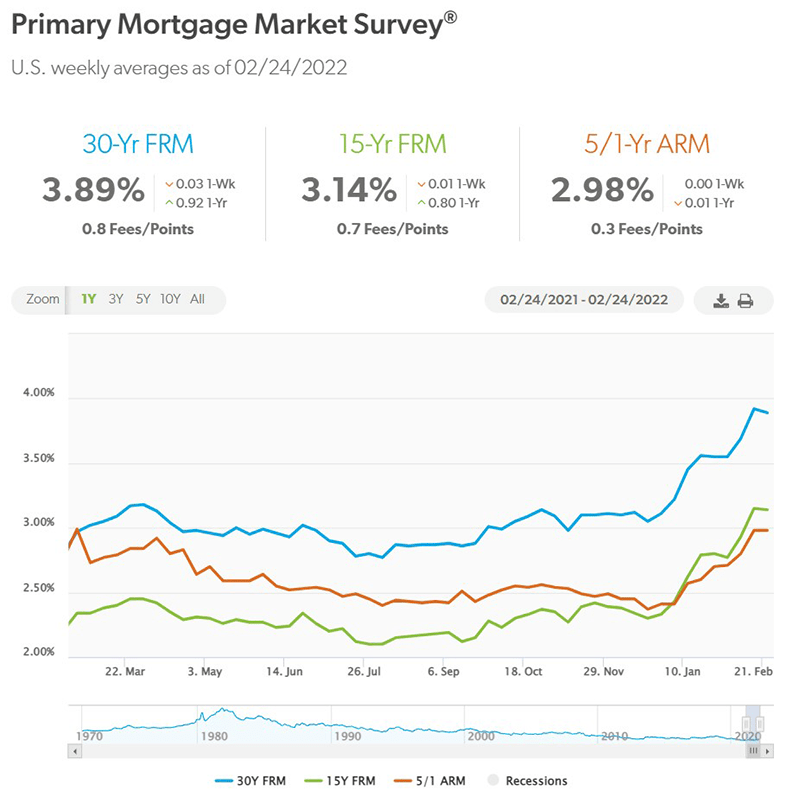

As mortgage rates continue to climb, prospective home buyers will have to contend with higher mortgage payments. In addition, rising home prices combined with limited inventory created affordability double-trouble with fewer homes affordable to buyers based on their income level. Fortunately, the growth rate in new listings relative to last year became positive this week for the first time in 2022. We’ll watch this indicator closely in the weeks ahead to see if more homeowners are deciding to sell, as our recent homeowner survey suggested they would.

Key Findings:

The median listing price grew by 12.9 percent over last year.

After a period of steady 8.5 to 9.0 percent growth in the fall, the median listing price for homes ratcheted back up to a double-digit pace in December as sales prices also held at recent highs. In 2022, not only has price momentum held, so far it has increased. The Freddie Mac fixed rate for a 30-year loan Mortgage rates hit 3.92% last week, the highest rate since May 2019. As mortgage rates begin to rise, and are expected to continue to increase, shrinking housing affordability has become a primary concern for more buyers. Our 2022 Housing Forecast expects a slowdown in home price growth to low-single digits for the year as higher rates reduce homebuyer purchasing power, but the median list price hasn’t yet moved in that direction.

New listings–a measure of sellers putting homes up for sale–were up 21.3 percent from last year’s stormy week.

In a housing market short on inventory, new home listings are a key indicator for future home sales. They indicate the number of sellers putting homes up for sale, in other words fresh supply. While new listings started on a somewhat weaker note and have trended below previous year levels since the beginning of 2022, the annual rate of decline has steadily improved over time and turned positive this week. Even after adjusting for the storm-related factors, the growth rate in newly listed homes remained positive, 3.2%, suggesting a breakthrough in housing supply.

Active inventory is down 23 percent from a year ago.

Even though new listings jumped this week, buyer interest kept outpacing new selling, and we still see a sizable gap in the number of homes actively for sale relative to last year. On the plus side, the gap shrank to its smallest since September 2021. Existing home sales started the year at a 12-month high pace, suggesting that buyers remained active at the end of 2021. With rising mortgage rates sapping buyer purchasing power, it will be important to watch both inventory and sales trends to determine whether rising inventory is due to an increasing number of sellers or decreasing number of home shoppers.

Strong buyer interest drives time on market down 20 days from last year’s stormy week.

Homes kept selling faster this week and successful buyers have to move quickly. Homes spent 20 days less on the market than the stormy week last year and 12-13 days less after adjusting for the weather’s impact. For context, a typical home spent just 61 days on the market in January, faster than any pre-pandemic year’s January. This market can be especially challenging for first-time buyers who may hesitate to contend. At the same time, surging rents, which were up nearly 20% from a year ago in January, provide a strong incentive for first-time buyers to continue to shop. This is especially true in markets in the South and Midwest where homebuyers may spend less on a monthly payment than they would renting.

Realtor.com